Best Info About How To Detect Payroll Fraud

How to detect and prevent payroll fraud?

How to detect payroll fraud. You can compare your pay data. When an employee makes a huge purchase such as an expensive car, a house or a trip abroad. When a new employee is added, your system can let you know if there are duplicate sin numbers.

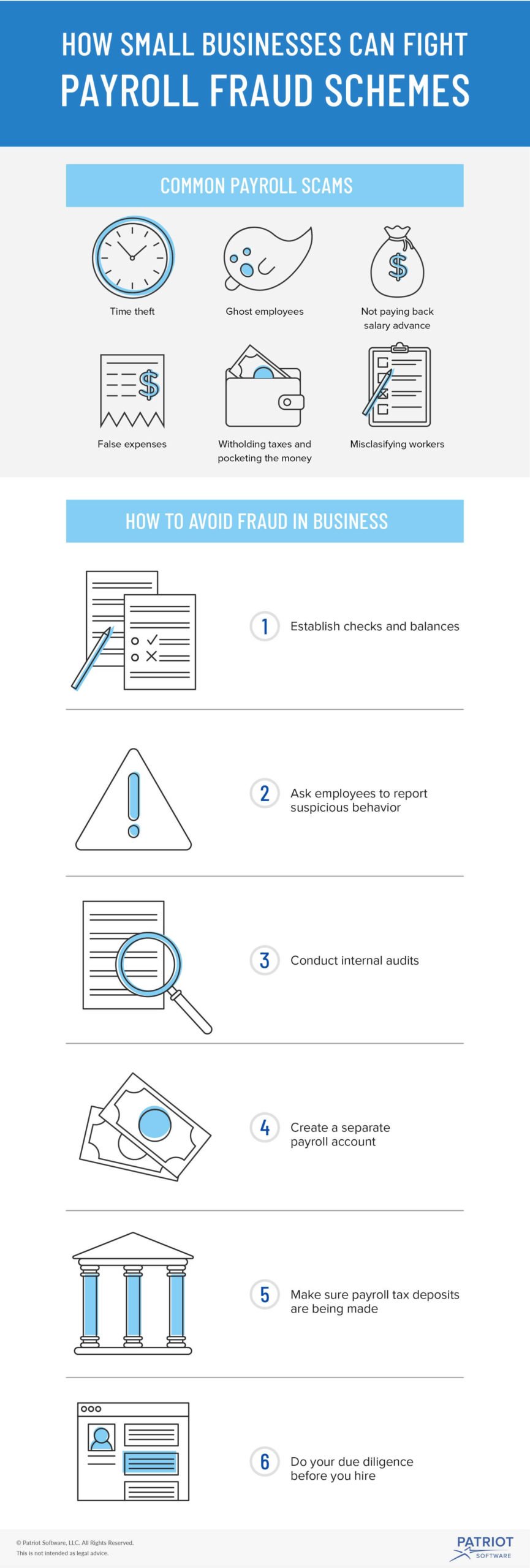

There are many ways to detect if an employee is committing payroll fraud by manipulating their wages through whatever type of payroll system you are using. Conduct a background check after that. Here are seven safeguards that can help detect payroll fraud before it snowballs, and reduce the likelihood of it happening at all.

If the accounting department charges this advance to. Timesheet fraud timesheets are used to measure how much an employee should be paid according to their attendance and hours to be paid, which makes it susceptible to. 28 red flags of payroll fraud while payroll fraud is hard to prevent, quarterly audits and payroll data analysis can be used to find red flags for payroll fraud.

Fbi statistics show that employers lose more than $8 million a year to reported. Review payroll reports each pay period, after. When an employee asks for an advance payment and doesn't pay it back, the employee has committed payroll fraud.

However, a few red flags to watch out for include: This can be easily detected by an experienced audit firm services in singapore, like ackenting group. However, you must find out whether there is fraud.

That’s why it’s critical to detect and report the fraud to get compensation by filing a lawsuit. Errors or gaps in payroll. There are many ways to detect if an employee is committing payroll fraud by manipulating their wages through whatever type of payroll system you are using.