Neat Tips About How To Improve Dso

Leveraging automation can reduce dso, which in turn increases your company’s cash flow.

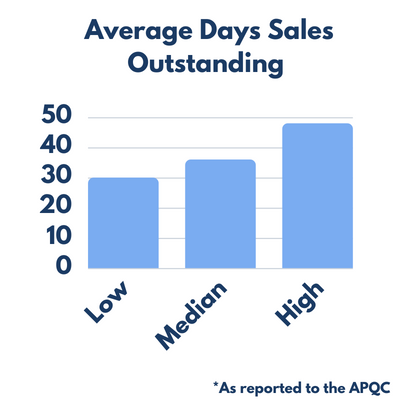

How to improve dso. Dso = (5/30) x 365. Here are some tips to follow if organizations want to improve their invoicing strategies: Days sales outstanding is the total period required to collect the.

Any effort to reduce dso must begin withgathering data on a company’s current. The longer it takes for a customer to get an invoice, the longer it takes for them to get your cash. Trade credit insurance remains one of the most efficient solutions to ensure the stability of your dso.

Streamlining the collection, deduction management, and cash application process. Therefore, any effort to reduce dso must address customer credit risk and. To have better tracking of billing & invoicing, organizations should resort to eipp.

Hence, dso = 61 days. 7 strategies for better accounts receivable management step 1: There are many ways to reduce your dso.

It can also reduce the rate of overdue invoices by ensuring invoices and reminders. The easiest way to reduce dso is through lightning fast invoicing. Don’t worry, there’s a simple solution and it involves managing your days sales outstanding dso.

Dso is often driven by customers’ ability to pay their invoices on time. If you keep applying these. Gather data about current dso status.

/TermDefinitions_DSO.asp-1b5156da55a84e2b9adf48b6668f5de4.jpg)